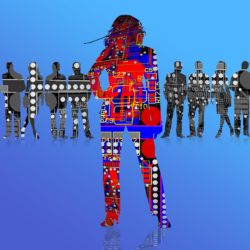

The Female FinTech Revolution: AI Edition

Women have spent generations making a name for themselves in the work world and gaining control over their finances. The female market is now a strong market for financial firms to target, but you have to know how to reach them. That being said, technology is giving us new ways to reach and interact with our customer base, allowing us the opportunity to offer unique services that better meet people’s needs.

Although women care about their finances and financial security, they are less likely to reach out to typical (human) advisors and have less knowledge of their financial health because of this. The reason for this hesitancy very likely lies in the gender bias that remains in the financial field. If the psychology and language is tailored for a specific group that does not include you, it’s understandable if you don’t feel comfortable in the space.

This of course creates a great opening for entrepreneurs wanting to reach untapped areas of the market. New startups are exploring the female financial field and bringing forth amazing new options.

Joy is potentially the most controversial option on the market, but the logistics behind the app make it a strong contender for women seeking financial advice. The system uses AI to first determine your personality traits and then offers a robot coach that best suits your needs. The language also differs from typical robo-advisors, choosing instead a dialect that is less confrontational. Seeking to make dealing with finance a positive experience, humorous language is used and users are often asked to explore which purchases bring them the most, well, joy. For users who want a less heavy relationship with their finances Joy will be a great new addition to the market.

Brolly is using the AI technology to improve and modernize the insurance experience, making it easier for the modern female (or male) to manage her insurance portfolio. The app gives a clear view of the insurance options available to the user and the AI will offer suggestions and advice to help make the decision process easier. As insurance is stressful enough, the addition of an AI guide will likely improve the experience for anyone not fully confident in their insurance knowledge.

The breakthrough that will most likely catch people’s attention is Jibo. A clear example of what people tend to think of when they think of artificial intelligence (Jibo actually looks like a little robot) Jibo will interact with users and help make life easier. The brainchild of Cynthia Breazeal, it is set to raise the bar when it comes to how intelligent and approachable our AI devices are. Designed to help, the Jibo model could radically change how we think about finance coaches or mentors.

Finance needed a revamp and FinTech was ready to take lead. Now, with innovative entrepreneurs taking charge of the upgrades, the new finance world is starting to take shape. This new world and its new way of looking at finance will help make the system more accessible for everyone, offering options that better meet certain people’s needs. This is the great benefit that comes from AI, which is why it is an area that deserves more exploration. AI and FinTech will truly make finance accessible to the masses, remaking the financial institutions in order to better reflect the end user.